Politicians and governments in the US and elsewhere have lately proposed or applied wealth taxes to complement income and cut back wealth inequality. In a brand new examine, Samira Marti, Isabel Z. Martínez, and Florian Scheuer present how decreases in wealth taxes led to will increase in wealth inequality in Switzerland, although they discover that these decreases alone are usually not sufficient to elucidate the magnitude of widening disparities.

Moderately than incomes common earnings, many super-rich, notably founders of profitable companies, equivalent to Elon Musk, Warren Buffet, or Jeff Bezos, earn their earnings from capital positive factors, that’s, the revenue from promoting an asset for multiple paid for it. Unrealized capital positive factors (these property which have gained worth on paper however haven’t but been offered) are usually not taxable in most nations, and even when realized, capital positive factors are usually taxed at a lot decrease charges than peculiar earnings. As capital positive factors are concentrated among the many wealthiest, total tax progressivity has corroded to the diploma that the typical tax fee millionaires and billionaires pay may be decrease than that of people in decrease earnings brackets. Whereas the typical American pays 13% in federal earnings taxes, in response to a White Home evaluation, the wealthiest 400 households in the US solely paid on common 8.2% in federal earnings tax between 2010 and 2018.

In response, a number of candidates through the 2020 U.S. presidential election proposed a federal wealth tax. Most prominently, Massachusetts Democratic Senator Elizabeth Warren known as for a 2% yearly “ultra-millionaire tax” on People with a web price over $50 million, and 6% on these with wealth exceeding one billion. Vermont unbiased Senator Bernie Sanders’ plan was much more progressive, with a tiered method beginning at 1% for fortunes above $32 million and rising as much as 8% on web wealth over $10 billion. Whereas neither candidate received the election, wealth tax proposals have continued to realize traction within the U.S. and different nations. Some 64% of People help a wealth tax on the super-rich, together with 77% of Democrats and 53% of Republicans, in response to a 2020 Reuters/Ipsos ballot. In step with the concept of creating billionaires pay “their fair proportion,” President Joe Biden has proposed tax will increase on the wealthy, particularly on capital positive factors, in his finances for fiscal yr 2024. Different nations have lately launched wealth taxes, equivalent to Colombia in 2019, or raised current wealth taxes on the wealthy, like Argentina in 2021.

Proponents of a wealth tax argue {that a} extra progressive tax system wouldn’t solely be fairer but in addition assist mitigate rising wealth inequality. In 2019, the highest 1% wealthiest people within the U.S. owned 35% of complete wealth, up from 22% in 1978, in response to the World Inequality Database. The richest 5% had been the one group to have gained wealth because the 2007-8 Nice Recession. Though the information reveals huge wealth inequality and regressive tax schemes, there was little systematic proof displaying how (progressive) wealth taxes truly have an effect on wealth focus.

In a brand new examine, we tackle this query by exploiting the decentralized construction of the Swiss wealth tax, the place every of Switzerland’s 26 cantons (states) units its personal charges, as a laboratory setting. Whereas 12 European nations levied an annual tax on web wealth within the Nineties, solely three—Norway, Spain, and Switzerland—nonetheless levy such a tax. With wealth tax income amounting to three.8% of complete authorities income, solely Switzerland raises a stage of income similar to latest proposals put ahead by Senators Sanders and Warren within the U.S. The Swiss instance is subsequently of specific curiosity to the continuing coverage debate within the U.S. and elsewhere.

The wealth tax has an extended custom in Switzerland and even predates the trendy earnings tax. The Swiss states, known as cantons, have been taxing wealth because the early 18th century—actually, this was their most important income till World Conflict I. As well as, wealth was taxed on the federal stage between 1915 and 1959. Since then, there was no federal wealth tax however all cantons should levy a complete wealth tax, which they’ve important freedom to design. The bottom of the Swiss wealth tax is broad: in precept, all property, together with these held overseas, are taxable. Solely widespread family property, overseas actual property, and personal pension wealth are exempt from wealth taxation.

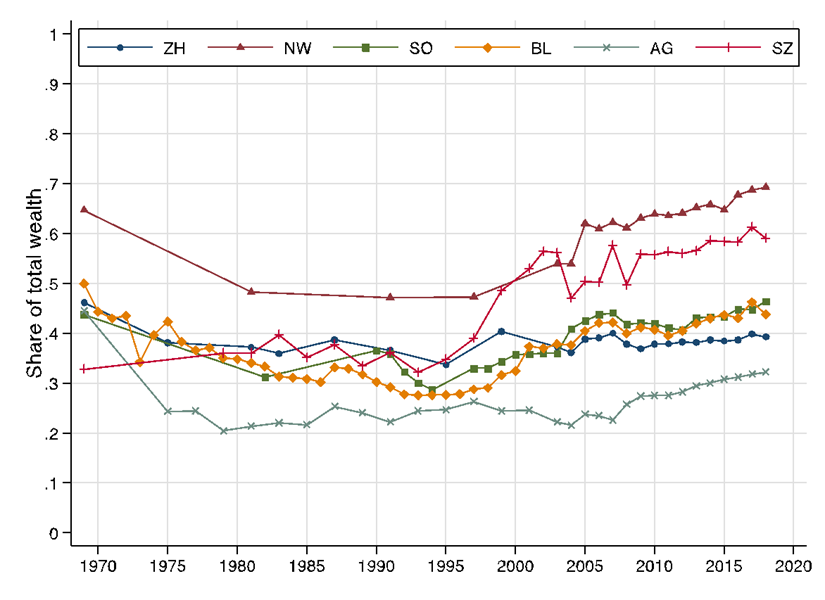

Primarily based on wealth tax statistics from cantonal archives, we assemble novel time collection for prime wealth focus in every of the 26 Swiss cantons since 1969. We discover that the general improve in wealth focus on the nationwide stage—the place the highest 1% wealth share reached 43% in 2019—masks placing variations throughout cantons, by way of each ranges of inequality and comparative traits between cantons (Determine 1). Whereas some cantons (equivalent to Zurich) have seen a discount of their prime 1% wealth share over the past 50 years, others (equivalent to Schwyz) have seen their shares nearly double.

Determine 1: Prime 1% wealth shares of the cantons Zurich, Nidwalden, Solothurn, Basel- Landschaft, Aargau and Schwyz, 1969-2018

For the reason that cantons have freedom in designing their wealth tax schedules, this raises the query to what diploma these diverging traits are pushed by variations in wealth taxation. We subsequently complement our data on cantonal wealth distributions with the corresponding knowledge on prime marginal wealth taxes, going again to 1964. Cantons have modified their prime tax charges 634 instances from 1969-2018 with an total downward pattern, however there exists important variation. For example, the best fee in our knowledge is 1.34% in Glarus in 1970, and the bottom is 0.13% in Nidwalden in 2014. A lot of the tax reforms decreased the highest marginal tax wealth fee by lower than 0.1 proportion factors, and the ten% largest reforms are related to a change within the tax fee of at the least 0.05 proportion factors.

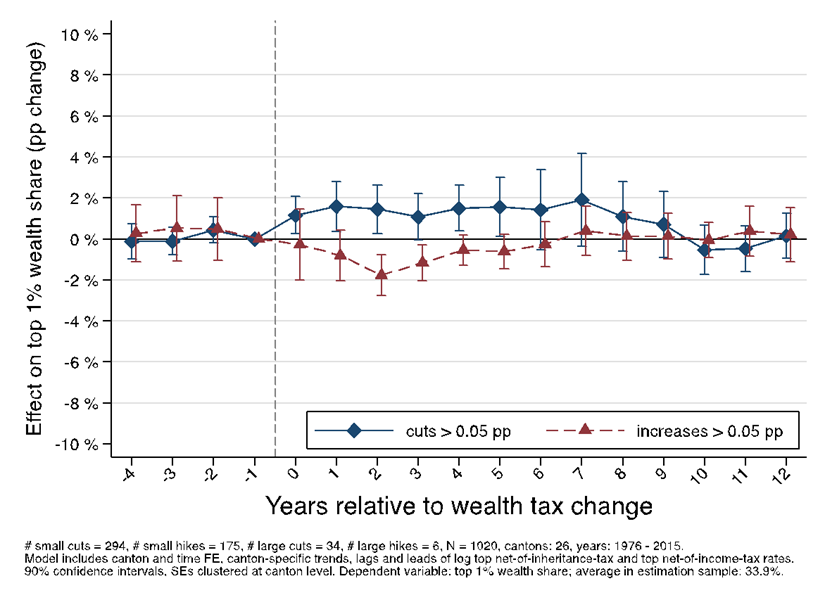

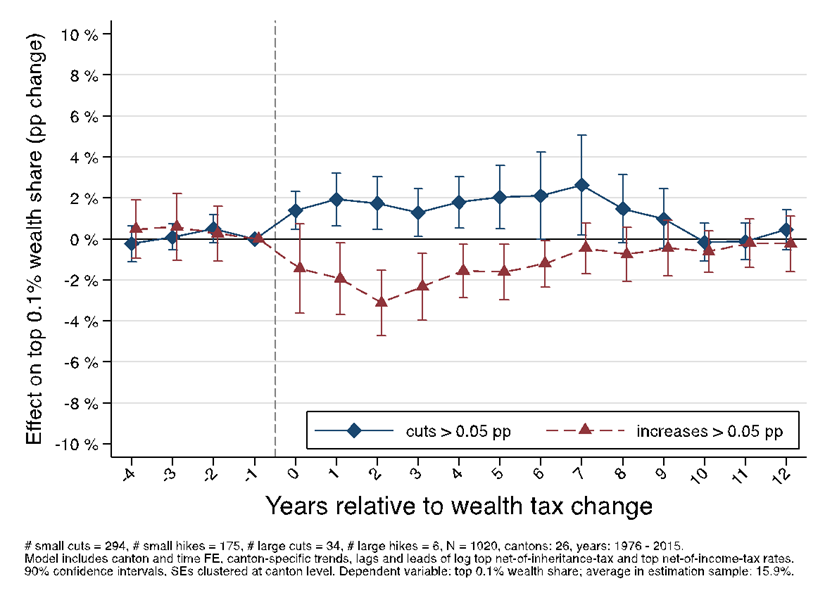

We use an occasion examine design to estimate the dynamic impact of cantonal wealth tax reforms on the next evolution of prime wealth shares. Specializing in massive tax reforms and controlling for earnings and bequest taxes, we discover that cuts to the highest marginal wealth tax fee in a given canton improve wealth focus in that canton over the course of the next decade, and that tax will increase cut back it. The impact is strongest on the very prime of the distribution. For the highest 1% and 0.1%, for example (proven in Determine 2), a discount within the prime marginal wealth tax fee by 0.1 proportion factors will increase their wealth share by 0.9 and 1.2 proportion factors, respectively, 5 years after the reform (in comparison with a median wealth share of 34% for the highest 1%, and 16% for the highest 0.1%). This means that the general discount within the progressivity of the wealth tax within the Swiss cantons over the past a long time explains roughly a fifth of the rise in focus among the many prime 1% and 1 / 4 of the rise in focus among the many prime 0.1% from 1969-2018. Observe that, in 2018, the highest 0.1% group solely included roughly 5,000 tax models. Thus, it’s an impressively small variety of the wealthiest households who benefited most from decreased wealth tax charges on the prime.

Determine 2a): Impact of huge wealth tax cuts and will increase on the highest 1% wealth share inside Swiss cantons

Determine 2b): Impact of huge wealth tax cuts and will increase on the highest 0.1% wealth share inside Swiss cantons

Whereas the wealth tax cuts clarify a large portion of the rise in wealth focus, they don’t seem to be the one attribute of the Swiss tax system to contribute to wealth inequality. Partly, it is because the wealth tax is just not very progressive in any canton, with average prime charges, particularly in comparison with latest proposals within the U.S. Moreover, the wealth taxes have comparatively low exemption quantities (beginning at round CHF 100K, equal to roughly $115K), implying that a big swath of the inhabitants is topic to it. Certainly, the Swiss wealth tax was by no means supposed to realize a significant redistribution of wealth, however relatively to generate secure revenues for the cantons and municipalities.

It’s possible that different modifications to the Swiss tax system over the past 50 years have performed a large function within the development of wealth inequality. Particularly, most cantons have abolished bequest taxes for direct descendants and there’s no bequest tax on the federal stage. On the identical time, bequests account for a substantial a part of the wealth of the super-rich in Switzerland. For example, Enea Baselgia and Isabel Z. Martínez present that, most lately, 75% of the 300 richest people in Switzerland inherited a lot of their wealth. That is extraordinarily excessive in comparison with the Forbes 400, the corresponding listing for the U.S. In 2018, 69% of the wealthiest People had been self-made, having based their companies. Quantifying the diploma to which the erosion of the cantonal bequest taxes has contributed to long-run wealth inequality in Switzerland could be an attention-grabbing matter for additional investigation.

Articles characterize the opinions of their writers, not essentially these of the College of Chicago, the Sales space Faculty of Enterprise, or its school.

Originally posted 2023-10-03 10:00:00.