In new analysis, Matthias Breuer, Anthony Le, and Felix Vetter discover that when firms are required by the federal government to hunt a third-party monetary audit, they flip to decrease high quality auditors. Because of this, the accounting trade grows, however touted advantages for markets and company stakeholders seem elusive.

Regulatory necessities for firms to acquire audits from personal, third-party auditors are ubiquitous. Such necessities goal to make sure that firms adjust to requirements and laws (e.g., monetary accounting or meals security requirements). They’re a cornerstone of economic and environmental laws and are commonplace in shopper markets. Nevertheless, the effectiveness of audit mandates has repeatedly been referred to as into query.

Excessive-profile audit failures, such because the Enron and Wirecard scandals, elevate issues in regards to the independence of auditors employed by auditees. For instance, Arthur Andersen, Enron’s auditor on the time of their collapse, got here beneath sharp scrutiny in 2002 for potential conflicts of curiosity because of the simultaneous provision of consulting and auditing companies. Along with issues in regards to the integrity of many audits, researchers have struggled to doc any clear good thing about audit mandates for auditees or the markets they function in. Accordingly, it stays unsure whether or not the mandates work and whom they profit.

Audit markets embody firms buying audits (i.e., clients), audit corporations providing audits (i.e., producers), and auditors auditing firms on behalf of audit corporations (i.e., workers). In a current paper, we conduct a complete examination of how these markets are formed by audit mandates making use of to monetary statements of firms within the European Union (EU) and determine a possible cause for why the mandates typically produce disappointing outcomes: they enhance demand for low high quality audits. The audit corporations and accounting career at massive are the primary beneficiaries of the federal government mandated demand for audits, whereas advantages accruing to different stakeholders are restricted.

Audit Mandates, Firms’ Audit Alternative, and Audit Agency Dimension

Within the EU, the Accounting Directives have required audits for the monetary accounts of limited-liability firms because the Eighties. This requirement, making use of to each personal and publicly listed firms, is extra expansive than the mandates in the US. In comparison with the U.S., with its sizable public-capital market and shareholder orientation, the emphasis of Europe’s accounting regulation lies extra on the safety of a broader set of stakeholders (e.g., clients, suppliers, and workers), together with shareholders.

The Accounting Directives enable EU member states to exempt personal firms from audit mandates in the event that they fall under two out of three thresholds referring to firms’ complete property, gross sales, and workers from the audit mandates. The EU member states decide the specs of those thresholds and have applied totally different exemption thresholds over time. We use the variations within the share of (industrial) firms topic to audit mandates to review the impression of audit mandates in the marketplace for audits.

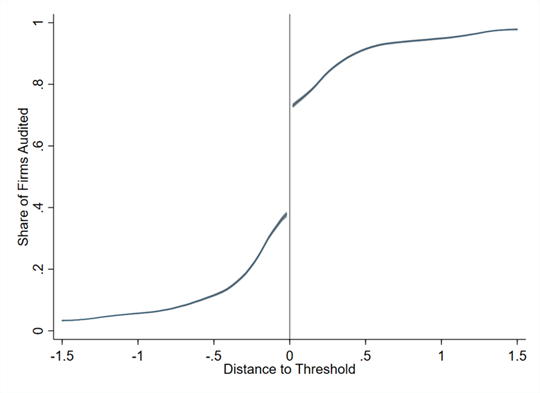

First, we discover that the chance of acquiring an audit will increase with an organization’s dimension impartial of any authorities mandate, reflecting the truth that bigger firms face larger monetary complexities and extra numerous stakeholders and thus have a larger personal demand to acquire a monetary assertion audit. However, inside a pattern of German firms, we discover that audit mandates result in a 63 proportion level enhance within the chance that an organization above the exemption thresholds obtains an audit. Determine 1 illustrates the bounce within the demand for audits for firms across the exemption thresholds. The determine exhibits a stark discontinuity in audit demand for firms simply above the brink relative to these just under.

Determine 1: Distance to Regulatory Threshold and Chance of Acquiring an Audit

Second, we discover that audit mandates profit the auditors by creating new demand, notably from smaller firms simply above the exemption threshold. Within the pattern of EU audit corporations, we discover that 10 proportion level enhance within the share of firms subjected to an audit will increase the dimensions of a given audit agency’s portfolio by 2.5%, reduces its common consumer dimension by 5.8%, will increase its complete property by 3.7%, will increase its complete variety of workers by 3%, and will increase its complete worker prices by 2.3%.

Third, utilizing detailed German administrative knowledge that enable us to separate employees by trade and occupation, we discover that the variety of auditors available in the market additionally grows. The impression of the audit mandates on the common wage throughout the audit occupation, nonetheless, is damaging. That’s, whereas the full compensation paid to all workers will increase because of the progress within the variety of auditors, the common wage paid to auditors decreases. At first sight, this outcome seems puzzling because it appears to recommend that extra auditors could be attracted with decrease wages. The puzzle could be solved by contemplating a crucial characteristic of the audit market: product differentiation.

Differentiation within the audit market can happen as a result of authorities mandates go away it to the businesses to decide on their auditor, in order that firms are ready to decide on audits of various “qualities.” For instance, prior analysis and traditional knowledge recommend that the “Massive 4” (i.e., Deloitte, Ernst & Younger, PWC, and KPMG) supply higher-quality audit companies at a steeper worth than smaller audit corporations. Firms that may not get an audit absent a authorities mandate are, thus, capable of receive low cost and lower-quality audits to adjust to the mandate. Thus, audit mandates can create additional demand for low-quality audits.

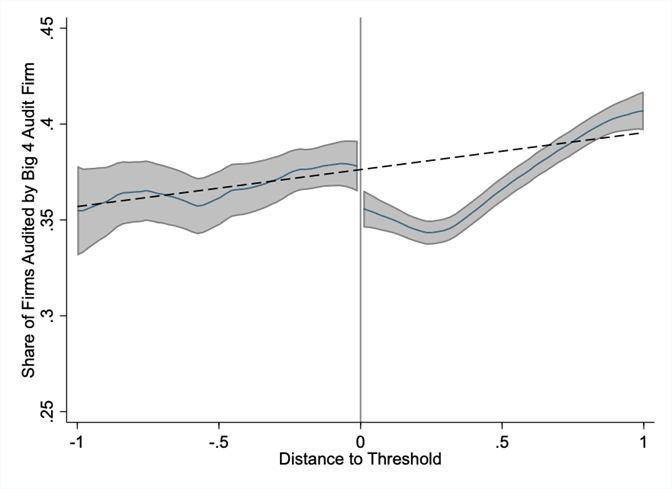

We discover this interpretation via a number of avenues. First, we study the kind of audit agency chosen by firms across the exemption thresholds. In Determine 2, we discover that, among the many firms that receive audits, these simply above the exemption thresholds are a lot much less more likely to buy an audit from a Massive 4 agency (i.e., an indicator of a high-quality audit) relative to these just under.

Determine 2: Distance to Regulatory Threshold and the Proportion of Firms Audited by Massive 4

Second, we study how the everyday audit agency within the audit market adjustments in response to audit mandates. We observe that audit mandates, if something, lower the common dimension of audit corporations inside a given nation. Notably, these outcomes distinction to the sooner discovering that mandates considerably enhance a given audit agency’s dimension. As with the auditors’ wages, this discrepancy hints at a compositional shift. Whereas a given audit agency could develop because of the mandates, the common dimension of audit corporations within the nation decreases because of the entry of many smaller audit corporations serving the low-quality demand.

Alongside these strains, we discover that audit mandates result in substantial entry of recent audit corporations and decreased audit-market focus. Within the pattern of EU audit corporations, we discover {that a} 10 proportion level enhance within the share of firms subjected to an audit inside a rustic will increase the variety of audit corporations by 7% and reduces the audit agency Herfindahl-Hirschman Index (HHI), a measure of market focus, by 9%. Notably, smaller audit corporations seem to make use of auditors with decrease earnings potential. These findings are per smaller, newly getting into audit corporations producing decrease high quality audits in comparison with massive, established audit corporations which have vital technological infrastructure and make use of extremely certified workers.

Our outcomes solid doubt on the effectiveness of audit mandates for making certain compliance with laws and requirements (e.g., monetary accounting or environmental requirements). They spotlight that, in differentiated audit markets, the place corporations can select their most popular compliance mechanism, we must always not essentially count on obligatory audits to result in substantive compliance with the audit mandate. The shortage of substantive compliance implies that, in the end, significant market-wide enhancements are unlikely to materialize. On this vein, we don’t discover vital advantages of audit mandates accruing to firms and their stakeholders (e.g., productiveness, tax assortment, or well-being), in step with the disappointing outcomes documented in a lot of the prior literature. Our research’s proof that audit mandates primarily increase the decrease high quality phase of the audit market supplies a possible rationalization for the disappointing outcomes. This lesson is especially necessary and well timed given current efforts to mandate the verification of ESG info (e.g., within the European Union) in an try to fight greenwashing.

Our outcomes present one participant that seems to learn from audit mandates: the audit trade. By forcing corporations to purchase audits no matter their worth, audit mandates seem to extend the dimensions of the audit market and career. This enlargement of the audit market, nonetheless, is primarily pushed by extra low-quality audits offered by low-quality audit corporations and auditors. The elevated dimension of the career could include larger financial significance and political affect within the brief run. In the long term, nonetheless, the shift towards low-quality audits could erode the general public’s belief in and standing of the career.

Articles characterize the opinions of their writers, not essentially these of the College of Chicago, the Sales space College of Enterprise, or its college.