Capital markets are central to capitalism and the functioning of the US financial system. But, short-selling, an integral a part of value discovery in capital markets, has been blamed as a contributor to the latest banking disaster. Lawmakers and curiosity teams have labeled quick sellers opportunists who prey on small traders and the general public with out justification. The authors make clear this debate and query the advantage of the allegations.

March via Could of 2023 will likely be remembered in US banking historical past as interval of confusion and reflection by financial institution analysts who failed to look at the fundamental monetary studies filed by a significant financial institution with the SEC, by regulators and supervisors who discovered themselves in indefensible positions in delivering their mandates, and by traders and the general public who misplaced billions of {dollars} and puzzled if they should save the banking business once more with their restricted assets.

Silicon Valley Financial institution, which had $212 billion in complete belongings and $312 billion in complete consumer funds as of the tip of 2022, closed on March 10, 2023. Signature Financial institution, listed because the 19th largest financial institution in the US by S&P International in December 2022, closed on March 12, 2023. First Republic Financial institution, which was the 14th largest U.S. financial institution with an enterprise worth of greater than $19 billion in 2020, turned the third giant, publicly traded financial institution to shut its doorways on Could 1, 2023.

In response to those closures, Harrison Miller reported on Could 5th that the American Bankers’ Affiliation (ABA) had referred to as for a probe into quick sellers profiting off of the financial institution disaster and had acknowledged that the quick sellers’ trades have been “disconnected from the underlying monetary realities.” The president of the ABA mentioned that “the hurt brought on by quick promoting that runs counter to financial fundamentals finally falls on small traders, who see worth destroyed by others’ predatory conduct.”

Chris Matthews studies that on Could 8th, Mark Fitzgibbon and Stephen Scouten, who cowl the sector for Piper Sandler, wrote to shoppers that “regional financial institution turmoil has elevated at a tempo that’s disconnected from the fact of fundamentals.” Matthews additional notes that the gents “argued that the Securities and Trade Fee ought to institute a ban on quick gross sales of regional financial institution shares, to offer Congress time to agree on a plan that raises deposit insurance coverage limits and cease any budding financial institution runs that could possibly be impressed by weak spot in regional banks.” Lastly, Chris Matthews writes on Could 16th that “Republican Rep. Warren Davidson of Ohio has requested that financial institution regulators examine whether or not the run on deposits at Silicon Valley Financial institution have been orchestrated by quick sellers searching for to revenue from the financial institution’s failure.”

On the very least, skilled employees at the US Securities and Trade Fee (SEC) have been against the implementation of a brief sale ban. On Could 5th Bloomberg reported that Anne-Marie Kelley, a former longtime senior SEC official and adviser to a number of chairs, acknowledged that “prior expertise with a brief sale ban in 2008 confirmed it was counterproductive, fueled panic, and truly undermined confidence within the monetary sector, so we have to proceed terribly cautiously and judiciously so as to not worsen issues within the banking sector.” On Could 8th FOX Enterprise reported that “if Securities and Trade Fee Chairman Gary Gensler desires to ban quick promoting of regional financial institution shares, he should do it over the objections of the company’s profession staffers.”

The graph offered in Determine 1 illustrates that (quick) promoting will not be related to the decline in Silicon Valley Financial institution’s inventory value previous to its closure. We use a black line to plot the closing costs for Silicon Valley Financial institution (obtained from CRSP) within the days previous to its closure. The pink line is a plot of the every day indicative annualized payment paid by traders who borrowed shares of Silicon Valley Financial institution to quick earlier than and after the financial institution’s closure. We receive these information from IHS Markit.

The graph clearly exhibits that borrowing prices solely turned elevated, indicating an elevated demand to quick Silicon Valley Financial institution’s shares, after the financial institution’s inventory value fell by 50% on March 10th (presumably in response to the announcement that the financial institution was closing).

Lastly, we use a purple line to plot the every day purchase/promote imbalance for Silicon Valley Financial institution’s inventory within the days main as much as March 10th utilizing information offered by WRDS. The every day purchase/promote imbalance is computed by dividing the distinction in purchase and promote buying and selling quantity by the sum of purchase and promote buying and selling quantity and the measure doesn’t differentiate between lengthy and quick gross sales.

As illustrated within the graph, within the days previous to Silicon Valley Financial institution’s closure, every day imbalances have been lower than 5% and have been each optimistic and unfavourable. In different phrases, it doesn’t seem that imbalanced gross sales are chargeable for the decline in Silicon Valley’s inventory value.

Determine 1.

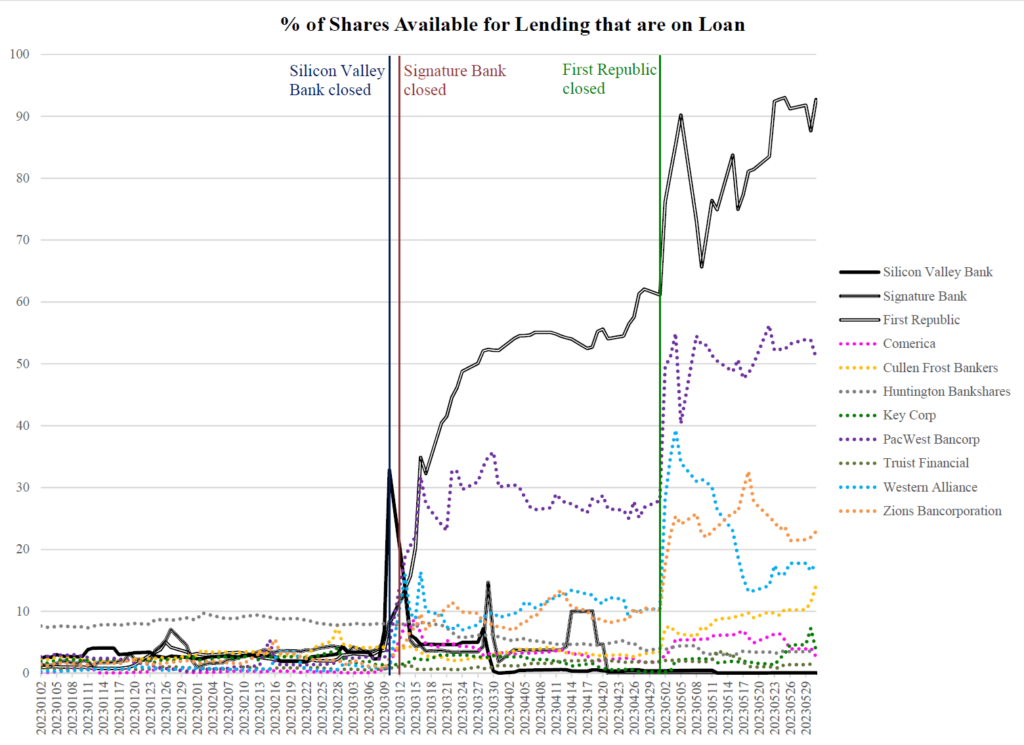

One other option to look at the exercise of quick sellers across the collapse of Silicon Valley Financial institution, Signature Financial institution, and First Republic is to look at the share of the shares which can be obtainable for lending which have been borrowed to provoke quick positions (e.g., the utilization charge). Schultz (2020) finds the median utilization charge for shares within the IHS Markit database is 8.76%, the interquartile vary is from 2.40% to 25.02%, and the 95th percentile utilization charge is 69.37%.

We determine eight further regional banks which can be talked about in articles as potential targets of quick sellers. Determine 2 incorporates a plot of the utilization charges for the three closed banks and the eight further ‘management’ banks from March 2nd via Could 30th of 2023. The info are obtained from IHS Markit.

Within the weeks earlier than Silicon Valley Financial institution’s closure on March 10th, the financial institution with the best utilization charge was Truist Monetary, whose utilization charge was between 7% and 10%. Apparently, the utilization charge for Truist falls after Silicon Valley Financial institution’s closure. Silicon Valley Financial institution’s utilization charge, which was lower than 7% within the weeks previous to the financial institution’s closure, rises from 7% on March 9th to 33% on March 10th after which falls precipitously over the subsequent a number of days.

At its peak, Signature Financial institution’s utilization charge was effectively beneath the 75th percentile utilization charge documented in Schultz (2020). Signature Financial institution’s utilization charge, which averaged 2.9% between January 2nd and March 8th, rises to five.4% on March 9th, 8.25% on March 10th, and peaks at 13.17% on March 13th. Apart from March 29th, Signature Financial institution’s utilization charge remained beneath 10% for the rest of March and all through April. Thus, Signature Financial institution’s utilization charge by no means exceeded the median utilization charge documented in Schultz (2020).

Determine 2.

Of the three banks that closed, First Republic had the best degree of quick promoting exercise. As seen in Determine 2, First Republic’s utilization charge peaked at 62% within the days previous to its closure. After First Republic closed, the utilization charge for shares of the financial institution rose to as excessive as 93%. Thus, within the days previous to and following its closure, the utilization charge for shares of First Republic was across the 95th percentile utilization charge documented by Schultz (2020). Whereas shares of First Republic have been obtainable to quick previous to the financial institution’s closure, the indicative payment (e.g., the price of borrowing shares) was excessive. The IHS Market dataset reveal that the indicative payment for First Republic rose from 19.8% on April 24th to 51.2% on Could 1st. The indicative payment was 88.1% on Could 2nd and peaked at 184.41% on Could 3rd.

Following the closure of Silicon Valley Financial institution, PacWest Bancorp was the one management financial institution whose utilization charge rose above the median utilization charge documented in Schultz (2020). Zions Bancorporation, Western Alliance, and PacWest Bancorp every had utilization charges that exceeded 25% on a number of days following the closure of First Republic. Nonetheless, all through the pattern interval from January 1st via Could 30th, the every day utilization charge for every of the eight management banks remained beneath the 75th percentile utilization charge documented in Schultz (2020) and the utmost indicative payment for these banks through the pattern interval was 17.93% (the indicative payment for PacWest Bancorp on Could 15th).

To summarize, utilization across the closing of Silicon Valley Financial institution and Signature Financial institution is broadly according to quick sellers buying and selling on data and never with quick sellers making an attempt to control costs. Utilization is small, lower than 10%, for the banks that went underneath and the opposite regional banks earlier than Silicon Valley Financial institution closed. There was no important shorting of any of those banks in any way earlier than the primary financial institution failure.

Proper after Silicon Valley Financial institution and Signature Financial institution have been closed, utilization elevated sharply for some, however not the entire different banks. That is according to quick sellers buying and selling on new data. Utilization didn’t improve over the subsequent couple weeks, as it might if quick sellers have been attempting to control costs. For every of the banks, much more shares have been obtainable to borrow and quick than have been really shorted. The exception to that is First Republic, which noticed growing utilization till it was seized by regulators. Quick sellers appropriately anticipated its issues. When First Republic closed, utilization instantly elevated for different banks, however didn’t proceed to extend as we would count on with manipulative quick promoting.

Manipulative quick promoting makes an attempt to revenue from quick promoting an asset that’s not overpriced. Even with out the prices and dangers of quick promoting, this isn’t simple to do. Suppose the quick succeeds in driving down the worth of a inventory by promoting shares with a downward sloping demand curve. In the end, the quick vendor must repurchase the shares at a cheaper price. If the inventory value fell by $10 because of promoting 500,000 shares, how a lot will the worth rise because the quick vendor makes an attempt to repurchase 500,000 shares? Any revenue from shorting is more likely to disappear when quick sellers try to shut positions.

This leaves two methods to revenue from manipulative quick promoting. One is to mislead traders with lengthy positions into pondering shares are overpriced. Quick sellers have been accused of doing this by spreading rumors or false data. However, as Ljungqvist and Qian (2016) present, it takes months for share costs to completely alter to unfavorable data launched by quick sellers that’s true. Over this time, the market ought to be capable to decide if data is fake. The second option to revenue from manipulative quick promoting with banks is to drive down a financial institution’s inventory value and in so doing spur a run on the financial institution’s unsecured deposits. This requires important strain on the inventory value which may be tough to take care of.

Quick promoting usually is a pricey and dangerous funding technique, even when the quick vendor appropriately identifies an overpriced safety. Quick sellers need to borrow shares. It could be tough to borrow shares in shares with small or reasonable numbers of shares excellent (like regional banks). As we have now seen, if there’s a number of curiosity in shorting, borrowing charges could also be excessive. Quite a few research have proven that closely shorted shares stay overpriced for a lot of months, so quick sellers pay excessive charges for a very long time. Throughout this time, the quick vendor could also be pressured to shut a place if the inventory lender remembers the shares he has borrowed.

Quick promoting is dear and dangerous when the quick vendor is true, however it’s even riskier and harder to revenue by manipulating costs via quick gross sales. The quick nonetheless has to pay the charges and bears the danger of their shares being recalled. As well as, as Lamont (2012) factors out, corporations have quite a lot of methods to combat manipulative quick promoting. They’ll request an investigation by the SEC or the trade. They’ll file lawsuits. They’ll challenge press releases to debunk quick sellers’ claims. Investigations and lawsuits are particularly more likely to bear fruit if the quick vendor is engaged in manipulative shorting.

To sum up, we tried to look at if there was a sample within the information that might converse to manipulative or opportunistic conduct on the a part of quick sellers that contributed to the present banking disaster. We didn’t observe any proof. We encourage others to look at the information as effectively. On the outset of any disaster, the general public, regulation makers and curiosity teams speculate what brought about the disaster. It’s unwise guilty a bunch with none foundation, on this case the quick sellers, and doubtlessly divert society’s assets.

Articles characterize the opinions of their writers, not essentially these of the College of Chicago, the Sales space Faculty of Enterprise, or its school.

Originally posted 2023-07-06 10:00:00.