In new analysis, Valentino Larcinese and Alberto Parmigiani discover that the 1986 Reagan tax cuts led to higher marketing campaign spending from rich people, who benefited probably the most from this coverage. The authors argue {that a} very permissive system of political finance, mixed with the erosion of tax progressivity, created the circumstances for the mutual reinforcement of financial and political disparities. The outcome was an inequality spiral hardly suitable with democratic beliefs.

Is democracy suitable with giant inequalities in materials wealth? This query is as previous as democracy itself, having drawn consideration not less than because the instances of the traditional Greek metropolis states. Within the Politics, Aristotle put the difficulty fairly starkly: “The actual distinction between democracy and oligarchy is poverty and wealth. Wherever males rule by cause of their wealth, whether or not they be few or many, that is an oligarchy, and the place the poor rule, that’s democracy.”

Up to date democracies nonetheless battle with the affect of cash in politics. Cash can be utilized to advocate or foyer in favor of particular insurance policies or to realize direct entry to policymakers. Rich people can purchase management of media shops and, on this approach, affect public opinion on political issues and public coverage. An unlimited literature additionally constantly exhibits that wealthier residents usually tend to vote and are usually higher knowledgeable on political issues: their preferences are due to this fact much less prone to be ignored by policymakers.

Rich donors purchase policymaking

Marketing campaign finance is one other avenue for cash to affect politics. Electoral campaigns are pricey, and policymakers require sizable struggle chests to compete. In American politics particularly, a lenient system of personal marketing campaign finance permits rich elites to make use of marketing campaign contributions to purchase political affect. Giant donations may also induce legislators to chubby the political preferences of financial elites, which are usually extra conservative than the remainder of the inhabitants on financial and monetary issues.

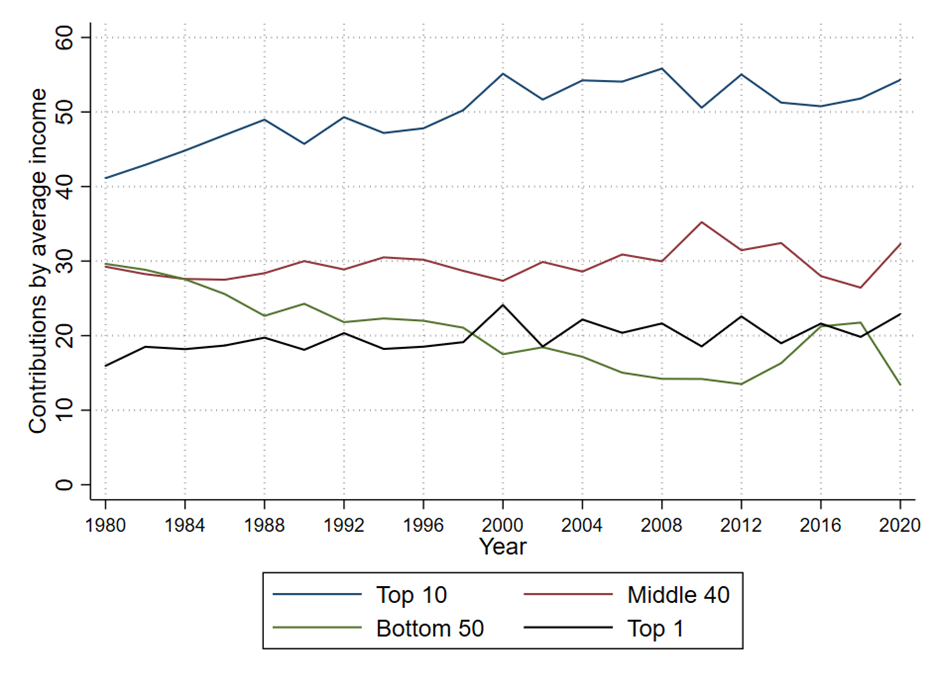

In a sequence of essential publications, a number of students have documented the rise in earnings inequality which occurred over the past half-century, notably concentrating earnings and wealth on the very prime. In our research “Revenue Inequality and Marketing campaign Contributions: Proof from the Reagan Tax Reduce,” we doc an analogous focus in particular person marketing campaign contributions among the many rich. Determine 1 exhibits that the share of marketing campaign contributions coming from the top-10% wealthiest census tracts (a geographical unit barely smaller than a zipper code) went from about 40% of the overall in 1980 to nearly 55% in 2020. In the meantime the share of the underside 50% halved, from nearly 30% to lower than 15%. The share of the highest 1% quantities to round 20% of complete donations in your complete interval, with a barely rising pattern.

Determine 1: The rising focus of particular person donations

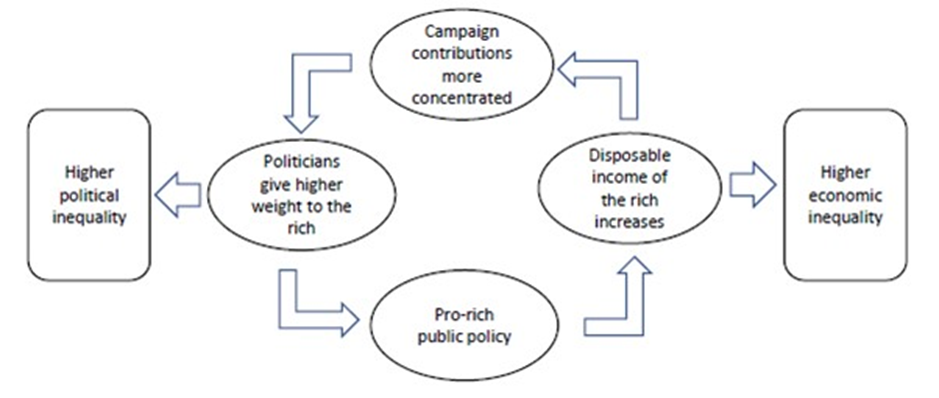

In step with the view that wealthier residents exert disproportionate affect on political selections, a number of survey-based research present that public coverage correlates effectively with the preferences of Individuals within the prime 10% of the earnings distribution. The correlation is nearly non-existent for the preferences of the remaining inhabitants. If cash may be translated into political energy by means of marketing campaign contributions and political energy can be utilized to implement insurance policies favorable to the prosperous, this will create an inequality spiral with mutually self-reinforcing inequalities of wealth and energy, as demonstrated in Determine 2. Taking taxation for example: 1) rich residents favor decrease taxes; 2) tax cuts enhance their disposable earnings; 3) having increased earnings, rich residents spend more cash in marketing campaign contributions; 4) rich donors change into a comparatively extra essential supply of marketing campaign cash for candidates in search of workplace; 5) additional tax cuts change into extra doubtless, which restarts the loop.

Determine 2: The inequality spiral

However does shopping for political affect feed again into bigger marketing campaign donations?

There’s convincing proof that marketing campaign contributions affect public coverage. Nonetheless, we aren’t conscious of any research that addresses the opposite thread of the spiral: does policy-induced higher disposable earnings result in bigger donations from people within the prime earnings brackets? That is the query we search to reply.

To deal with this query, we analyze the evolution of particular person marketing campaign contributions after the 1986 Tax Reform Act (TRA) adopted by the second Reagan administration. The TRA, one of many largest tax cuts within the historical past of the US, disproportionately benefited rich residents and drastically elevated their disposable earnings. Utilizing a difference-in-differences method and a novel dataset on the census tract degree, we discover that the tax financial savings delivered by the TRA brought about a rise in marketing campaign contributions from rich people. This rise was largely pushed by rich census tracts and, inside tracts, by taxpayers within the prime 10% of the earnings distribution, who benefited probably the most from the tax cuts.

Each Democratic and Republican candidates acquired extra donations, with magnitudes of comparable dimension. The post-TRA surge in donations didn’t correlate with the ideology of the recipients: utilizing well-established indicators to measure the ideological leaning of members of Congress, we can’t detect any related variations. We discover, nonetheless, that candidates who usually tend to be socially well-connected or to return from a privileged background profit disproportionately greater than different candidates.

Although it’s not all about affect

We additionally examine the the explanation why donors contribute to political campaigns to know higher the mechanism of this spiral. There are two predominant hypotheses on this regard. The primary views contributions as a political funding. Donations are a technique for people to help most popular candidates and insurance policies. For instance rich donors would possibly contribute to candidates who will enact tax cuts for the rich.

The second regards donations as a type of ideological consumption. On this perspective, donations are a type of political participation that donors have interaction in to precise their ideological preferences, with out essentially anticipating any influence on subsequent coverage. A department of this view, known as the “solidary motive,” presumes that donors contribute to political campaigns as a part of an anticipated social conduct amongst a particular social milieu to which like-minded and influential folks belong. For instance, it’s well-known that many people donate when requested by pals or acquaintances.

A number of research discover that, no matter what motivates donors, increased earnings tends to be related to bigger donations. We equally don’t detect any specific strategic motive behind the rise in donations after the Reagan tax minimize. On this sense, our outcomes don’t help the thought of particular person contributions as strategic investments. In truth, the disproportionate profit for recipients who usually tend to be socially well-connected or from a privileged background helps the interpretation of donations as pushed by a solidary motive. Giant donors and recipients are components of the identical social networks and are prone to share a desire for low taxes and different insurance policies which enhance inequality. Therefore, the inequality spiral depicted in Determine 2 seems to be extra rooted in social class than in partisanship or ideology, since change and reciprocation appear to be principally grounded on the widespread social background of donors and recipients.

Our conclusion, due to this fact, is that the inequality spiral can manifest its results even when donors aren’t performing instrumentally to safe the passage of particular public insurance policies. The mixture of regressive insurance policies with a lenient system of political finance naturally creates the circumstances for the mutual reinforcement of financial and political disparities, whatever the motivations of enormous donors. This mixture lays the groundwork for a possible slide in the direction of an oligarchic society, as it’s formed by social class and insurance policies that safeguard the pursuits of financial elites.