As a consequence of a change in how the FDIC resolves failed banks, uninsured deposits have turn into de facto insured. Not solely is that this harmful for threat within the banking system, it’s not what Congress intends the FDIC to do, writes Michael Ohlrogge.

The current failures of Silicon Valley Financial institution and First Republic have drawn consideration to how uncommon it’s for uninsured depositors at a failed financial institution to bear losses. Over the previous 15 years, uninsured depositors have skilled losses in solely 6% of United States financial institution failures. In a newly launched paper, I present that ubiquitous rescues of uninsured depositors characterize a current phenomenon relationship solely to 2008: for a few years previous to that, uninsured depositor losses had been the norm. I additionally present that the rise of uninsured depositor rescues has coincided with a dramatic enhance in Federal Deposit Insurance coverage Company prices of resolving failed banks, which I estimate resulted in a minimum of $45 billion in further decision bills over the previous 15 years.

The expansion of uninsured depositor rescues raises severe issues about ethical hazard in addition to fiscal prices. It additionally dangers violating the FDIC’s statutory requirement to resolve failed banks and shield insured depositors within the least costly means doable. I current proof that the very best clarification for the expansion of uninsured depositor rescues is that the FDIC has skilled “mission creep,” ensuing within the rescue of uninsured depositors way more incessantly than Congress supposed. This mission-creep occurred twice previously, and Congress efficiently intervened to cease it in 1951 and 1991. It could now be time for a 3rd such intervention from Congress.

The Least-Value Decision Requirement and the Systemic Danger Exception

Present legislation requires the FDIC to resolve failed banks within the least costly means whereas nonetheless defending insured depositors. As a reminder, the legislation stipulates that deposits as much as $250,000 held at any FDIC-insured financial institution are backed by the federal authorities. Typically, rescuing uninsured depositors could the truth is be the most affordable technique to shield insured depositors. As an illustration, suppose the failed financial institution will likely be bought by one other financial institution who will proceed to function it. The purchaser would possibly desire to maintain clients of the failed financial institution joyful by honoring even uninsured deposits, and thus would possibly pay extra for the failed financial institution’s belongings if uninsured depositors are made entire. If the additional quantity the acquirer can pay for the failed financial institution’s belongings is larger than the price of reimbursing uninsured depositors, then it will likely be cost-effective to completely compensate even uninsured depositors.

Ceaselessly, nevertheless, uninsured depositor rescues enhance the entire decision prices. If the FDIC believes it’s essential to rescue uninsured depositors, regardless of it not being the bottom price choice, then it should invoke the “Systemic Danger Exception.” This requires authorization from two thirds of the FDIC Board, two thirds of the Fed Board, the Treasury Secretary, and the U.S. president. The FDIC has invoked this solely twice for failed banks: SVB and Signature, each of which failed in 2023. Thus, the systemic threat exception shouldn’t be invoked calmly. On this paper, I argue that the FDIC has rescued uninsured depositors at lots of of failed banks in conditions the place doing so shouldn’t be least price, but with out going via the Congressionally mandated procedures for invoking the Systemic Danger Exception.

Causes to Fear About Extreme Uninsured Depositor Rescues

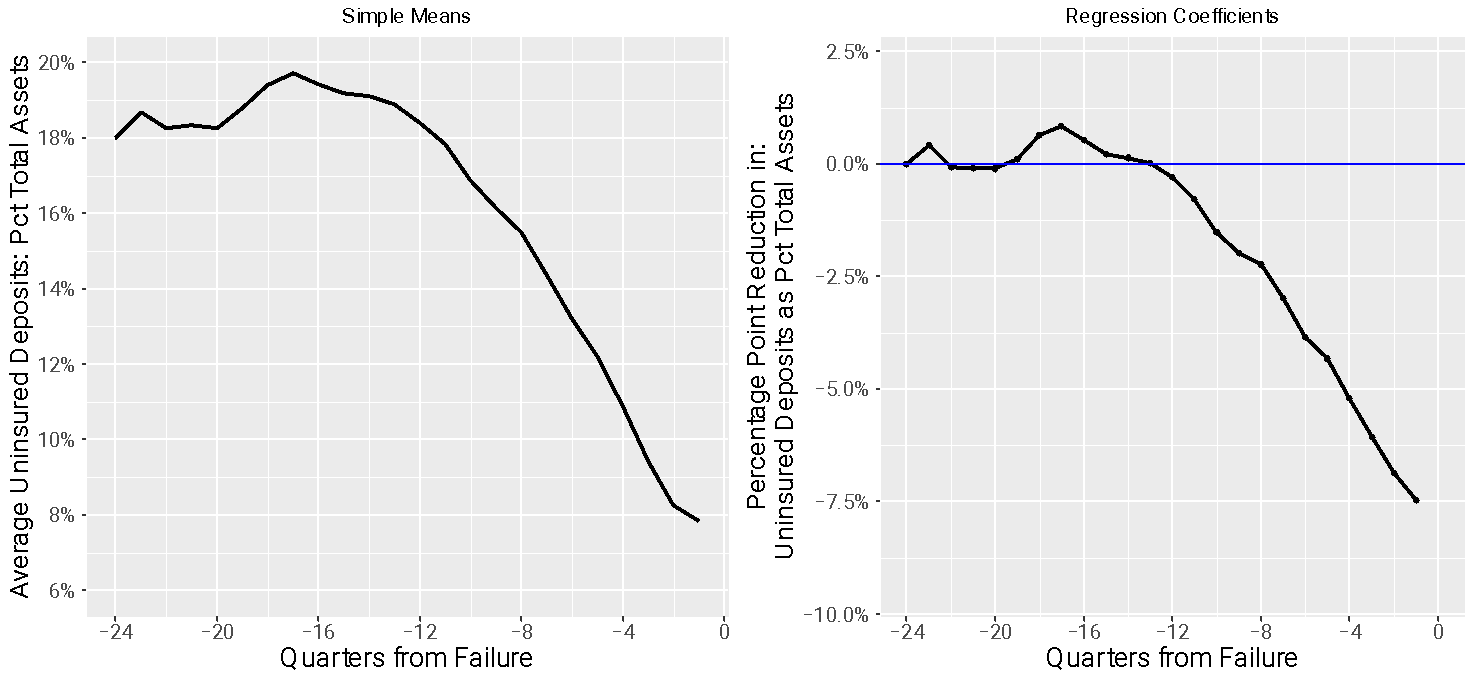

Past rising prices of resolving failed banks, extreme rescues of uninsured depositors run the chance of decreasing the incentives of uninsured depositors to observe banks, which might encourage banks to take extreme dangers. Current analysis reveals important proof, over many various time intervals, that uninsured depositors play an energetic function in monitoring and disciplining banks. (See the total paper for a listing of this analysis, which incorporates work by Anthony Saunders, Berry Wilson, Charles Calomiris, Joseph Mason, Andrew Davenport, Christopher Martin, Manju Puri, and Alexander Ufier.) The information I analyze affirm these outcomes. Determine 1 considers knowledge from all banks which have failed over the previous 30 years. Panel (a) reveals that on common, beginning 4 years previous to failure, the % of financial institution’s whole belongings which are funded with uninsured depositors begins dropping, with banks shedding roughly half or extra of their uninsured deposits by the point they fail. Panel (b) presents related leads to a regression type. The regression reveals that banks that fail lose considerably extra uninsured deposits in comparison with banks which are equally sized and in related geographic areas that don’t fail. Thus, uninsured depositors seem to concentrate on how protected the banks they deposit cash in are, they usually flee poorly run banks. This doesn’t assure that banks will at all times be prudently run, but it surely creates incentives for bankers to pursue protected methods, which helps to advertise monetary stability.

Determine 1: Flight of Uninsured Depositors from Failing Banks

If uninsured depositors don’t want to monitor the security of banks, there are different methods they will shield their funds. Sweep accounts, as an illustration, routinely transfer balances past a specified restrict (such because the FDIC insurance coverage restrict) into Treasury cash market mutual funds (MMFs) or related investments on the finish of every day. This allows the comfort of checking accounts together with the security of Treasury securities. Thus, imposing loses on uninsured depositors at failed banks doesn’t imply that each individual or enterprise with greater than $250,000 should essentially put their cash in danger.

Causes to Consider the FDIC Now Favors Uninsured Depositor Rescues

Though I can’t show it with full certainty, I present that there are quite a few causes to imagine that the FDIC has begun rescuing uninsured depositors even when doing so considerably will increase decision prices.

Motive #1: FDIC prices have risen dramatically on the similar time uninsured depositor rescues have turn into ubiquitous.

- Beginning in 1992 (when Congress adopted the present model of the least-cost decision requirement) via 2007,, the typical price of resolving failed banks, as a % of the failed banks’ belongings, was 10%. Uninsured depositors skilled losses in 63% of financial institution failures.

- From 2008 onwards, common prices of resolving failed banks have risen to 18.2% of failed banks’ belongings, and uninsured depositors have skilled losses in solely 6% of financial institution failures.

- Since I measure prices as a % of failed financial institution belongings, adjustments within the quantity or measurement of failed banks is not going to straight affect them. Moreover, the elevation within the FDIC’s prices persists nicely previous the tip of the 2008 monetary disaster. It likewise persists in regression analyses that management for the quantity of insured deposits banks have, financial institution measurement, the standard of financial institution belongings on the time of failure, and the set of establishments obtainable to bid on a failed financial institution’s belongings. Determine 2 plots yearly coefficient estimates from these regressions that measure the change in FDIC decision prices in comparison with prices from 1992-1999 (the interval instantly after Congress adopted the present model of the least-cost decision requirement).

- Whereas the tight correlation between rising prices and rising uninsured depositor rescues doesn’t show causation, there are robust theoretical causes to imagine that uninsured depositor rescues would trigger prices to rise. Moreover, neither the FDIC nor every other writers have proposed different explanations that may account for the FDIC’s dramatic rise in prices.

- I additionally present that the rise in prices the FDIC skilled in 2008, when it appears to have ceased following least-cost decision necessities, is akin to the drop in prices the FDIC skilled in 1992, when it started following the trendy model of the least-cost take a look at mandated by Congress.

Determine 2: FDIC Decision Prices In comparison with 1992-1999

Motive #2: The FDIC has twice previously acknowledged that it adopted a choice for rescuing uninsured depositors, even when doing so elevated decision prices.

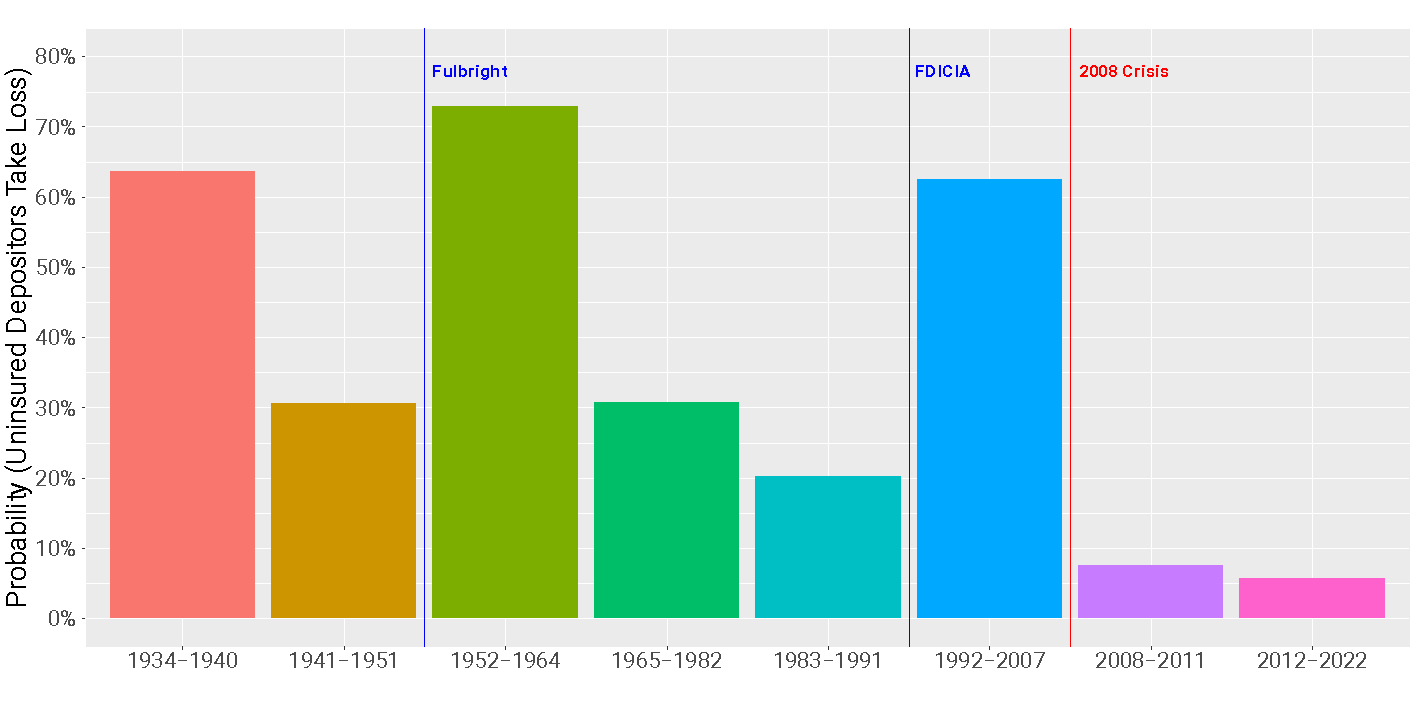

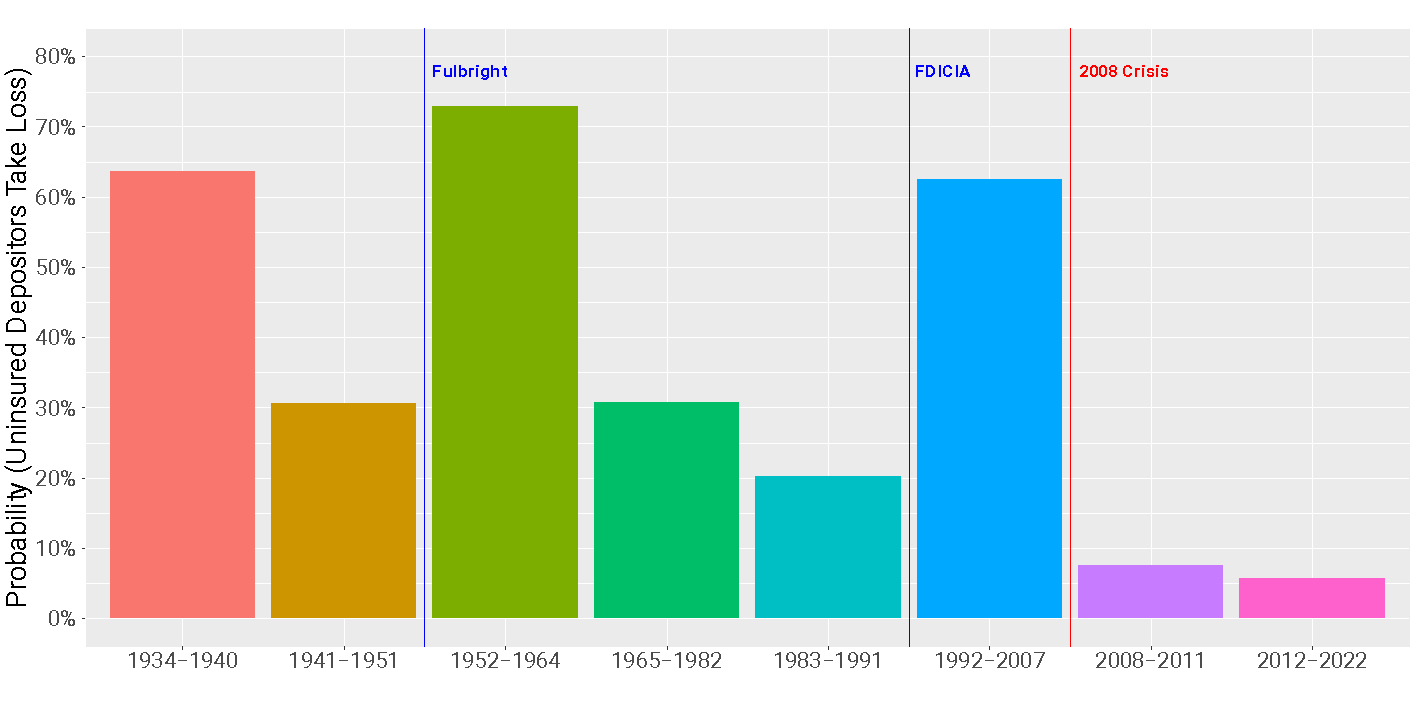

- Congress intervened in 1951 and 1991 to rein in what it considered as extreme depositor rescues, resulting in excessive prices and ethical hazard. Determine 3 plots the frequency of losses by uninsured depositors earlier than and after these Congressional interventions. The total paper offers extra particulars on these interventions.

Determine 3: Chance of Uninsured Depositor Loss, Given Financial institution Failure

Motive #3: Latest statements by the FDIC seem to acknowledge that it favors decision strategies that rescue uninsured depositors, even when doing so shouldn’t be least-cost.

- The FDIC has stated that beginning in 2009, when it performed auctions of a failed financial institution’s belongings, resolutions that rescued uninsured depositors had been “usually the one [option] supplied to potential acquirers.”

- The FDIC has additionally acknowledged that it favors decision strategies that rescue uninsured depositors as a result of they promote “monetary stability,” although Congress has been clear that if the FDIC needs to rescue uninsured depositors on account of monetary stability issues, it should search authorization via the Systemic Danger Exception.

Motive #4: If it had been least-cost to impose losses on uninsured depositors in 63% of failures from 1992-2007, why wouldn’t it now solely be least-cost to impose losses in 6% of failures?

- Such a dramatic change would recommend some elementary shift within the nature of banks or the banking business. But there is no such thing as a obtainable proof of such a shift that might clarify this.

Motive #5: Mechanisms for transparency and accountability are absent or have disappeared.

- Previous to 2008, the FDIC performed least-cost audits with some regularity, inspecting previous failures to find out whether or not it had resolved the banks in essentially the most cost-effective means. Put up-2008, these audits have primarily ceased. The FDIC has supplied no clarification for the cessation.

- The FDIC maintains strict secrecy concerning the strategies it makes use of to compute the prices of various decision strategies, making it not possible for outsiders to confirm the FDIC’s claims that rescuing uninsured depositors has now primarily at all times turn into the most affordable technique to shield insured deposits.

Further Issues

Within the full paper, I take into account a number of different doable explanations for adjustments within the FDIC’s prices and determination strategies over the previous fifteen years. Right here, I briefly survey a few of these issues.

Consideration #1: Is the FDIC merely responding to broader political forces that favor rescuing uninsured depositors?

- If the FDIC’s deviations from the least-cost requirement replicate a broader political consensus favoring uninsured depositor rescues, then the potential lack of statutory adherence could appear much less troubling.

- That is unlikely. Since 2008, there have been 12 failures of banks with over $1 billion in belongings the place uninsured depositors nonetheless took a loss. If there have been a broader political consensus in favor of rescues of uninsured depositors, the FDIC may merely have requested for Systemic Danger Exception authorization to rescue uninsured depositors in these instances.

Consideration #2: Can lack of FDIC capability assist clarify rising FDIC prices or depositor rescues?

- In 2008, the FDIC skilled important staffing shortages that took till 2010 to resolve.

- It’s doable that these staffing shortages led the FDIC to favor promoting failed banks as an entire, a technique that rescues uninsured depositors and that’s easier and simpler for the FDIC to implement.

- However, as Determine 2 and Determine 3 present, elevated prices and depositor rescues persist lengthy after these staffing shortages had been resolved.

- For this and related causes I current within the paper, I conclude that FDIC capability could clarify a small quantity of the change in FDIC prices and depositor rescues, however that it’s implausible that it’s a dominant driver of the dramatic adjustments proven in Determine 2 and Determine 3.

Coverage Reforms

There are a number of reforms that may enhance adherence to the FDIC’s least-cost decision requirement, and thus scale back decision prices and ethical hazard.

Firstly, Congress ought to require Authorities Accountability Workplace audits of the FDIC’s compliance with the least-cost decision requirement.

Secondly, when banks bid to accumulate a failed financial institution’s belongings, Congress ought to prohibit the FDIC from figuring out whether or not the bidders intend to rescue uninsured depositors. As an alternative, if the profitable bidder needs to make use of their funds to rescue uninsured depositors, they will achieve this on their very own accord. It will assist make sure the FDIC selects bids which are actually least price, somewhat than giving choice to bids that can rescue uninsured depositors.

Lastly, Congress ought to grant insured deposits precedence over uninsured deposits, matching the system in place in a lot of Europe. This contrasts with the established order within the U.S., which provides equal precedence to insured and uninsured deposits. This might additional scale back FDIC decision prices whereas bettering incentives for depositor self-discipline.

Articles characterize the opinions of their writers, not essentially these of the College of Chicago, the Sales space Faculty of Enterprise, or its college.