How prolific is the revolving door situation on the federal stage? In a brand new paper, Joseph Kalmenovitz, Siddharth Vij, and Kairong Xiao analyze the prevalence of revolving door habits in the USA authorities and focus on the impacts of limiting personal sector job prospects for regulators.

Regulators can depart their authorities place for a job in a regulated agency. This “revolving door” phenomenon is the topic of intense public debate. On the one hand, the choice for presidency officers to go away for the personal sector may incentivize them to manage markets otherwise if it would assist them acquire employment sooner or later, for instance, by exhibiting extra leniency towards regulated corporations. Alternatively, closing the revolving door may deter proficient people from coming into public service within the first place if it means they received’t be capable of translate their know-how and connections into extra remunerative employment after leaving the federal government. Regardless of the significance of the subject, there may be little proof on the prevalence of the revolving door incentive, its causal influence on the habits of regulators, or the efficacy of insurance policies which intention to restrict that impact.

In a latest paper, we use a novel dataset and a novel authorized setting to start out filling within the hole within the literature. We get hold of the employment information of twenty-two million federal staff over 20 years and exploit the truth that post-employment restrictions on federal staff set off when the worker’s wage exceeds a threshold. We doc vital bunching of staff just under the edge, according to a deliberate effort to protect their outdoors choices. Bunching regulators present leniency by pursuing fewer enforcement actions and lowering the compliance prices of many guidelines. Lastly, we incorporate our findings right into a structural mannequin and consider the implications of other insurance policies.

The Revolving Door’s Affect and Potential Interventions

A particular post-employment restriction covers senior federal staff: they’re barred for one 12 months from speaking on issues that pertain to their former company and from representing or advising international entities (Part 207(c) and Part 207(f) of the U.S. Code, Chapter 18). Any violation is topic to prison and civil fines and as much as 5 years in jail. Crucially, the restrictions are triggered by a wage threshold that equals 86.5% of the second-highest stage of the wage schedule used for high-ranking appointed officers within the government department. This threshold equaled $172,400 in 2021. This restriction provides a uncommon alternative to check how federal regulators reply to the revolving door: in the event that they want to protect their outdoors choice, they need to keep under the cutoff wage and thus keep away from triggering the post-employment restrictions. We take a look at this chance utilizing a novel dataset that covers all the civilian workforce within the federal authorities. Obtained via repeated Freedom of Info Act requests, it incorporates complete data on 22 million staff who labored within the federal authorities at any level between 2004 and 2021.

We begin by documenting causal proof for revolving door incentives. Utilizing a proper bunching estimator, we establish statistically vital bunching under the wage threshold in 33 federal businesses. This consists of monetary regulatory businesses such because the Commodity Futures Buying and selling Fee, Securities and Alternate Fee, and Federal Deposit Insurance coverage Company. This group additionally consists of businesses liable for managing and distributing authorities funds, such because the Farm Credit score Administration and the Federal Retirement Thrift Funding Board. On common, 49% of the personnel within the 33 federal businesses reply to revolving door incentives and settle for a $6,400 pay lower to remain under the edge, or 7.4% of the typical wage.

Determine 1: Sensitivity to Outdoors Job Alternatives

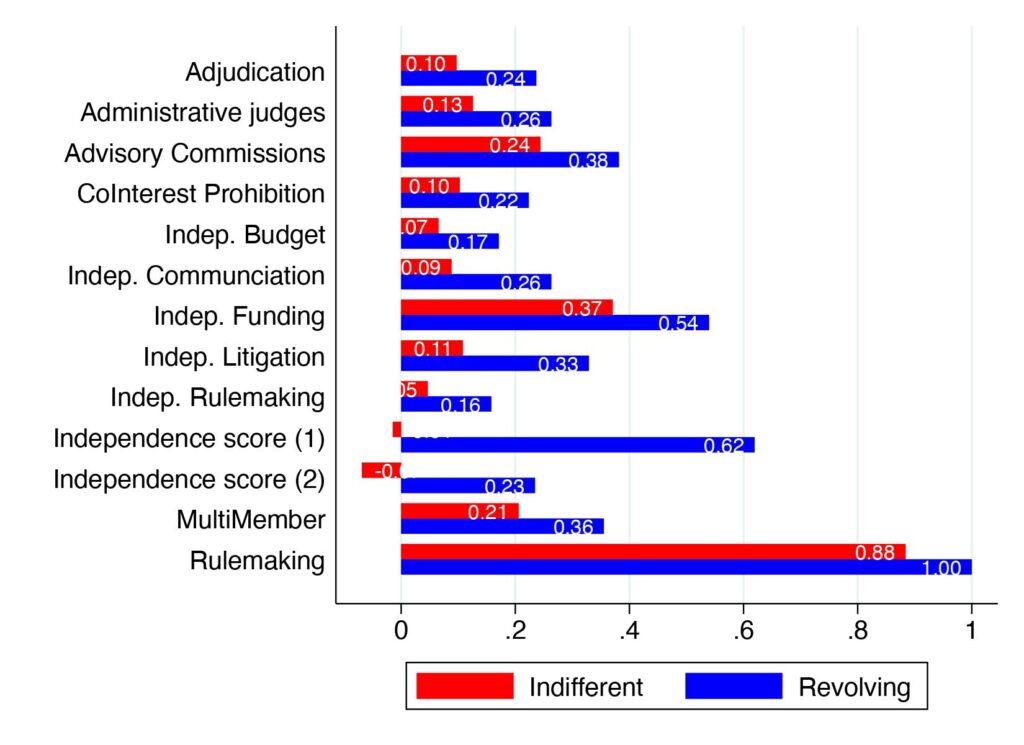

We additionally present that revolving businesses have better autonomy to train their regulatory powers—submitting enforcement lawsuits independently, as an example—and appeal to extra lobbying expenditures by industries that supply greater common pay.

Determine 2: Structural Variations Throughout Companies

Subsequent exams affirm that bunching is a strategic response by brokers who want to protect their outdoors choice. For instance, bunchers exhibit superior efficiency throughout their authorities stint by incomes extra promotions and bonuses. Nevertheless, as they arrive nearer to the edge, they settle for fewer promotions and a slower wage development. Bunchers usually tend to exit from the federal government and, conditional on exiting, they’re extra prone to flip to the lobbying trade. Bunching will not be defined by potential promotion bottlenecks: there aren’t any materials modifications in duties across the threshold, and bunching happens if and provided that the edge triggers a post-employment restriction. For instance, the SEC was exempt from the restriction till 2013, and certainly we observe bunching on the SEC solely from 2014 onward. Mixed, these exams affirm that bunching is a strategic alternative of regulators who search to protect the worth of their outdoors choice.

Within the second a part of the paper, we look at whether or not the revolving door motivates regulators to alter regulatory burdens. Current research supply two broad views. On one hand, it may result in regulatory leniency, for instance, if regulators search to curry favor with potential future employers (regulatory seize). Alternatively, regulators may select to vigorously fulfill their duties to construct their fame and human capital (regulatory education). Our evaluation is essentially according to the previous perspective. First, utilizing new knowledge on regulatory burdens, we present {that a} typical revolving company imposes 8.9 fewer guidelines, 9.5 million fewer paperwork varieties, and a couple of.1 million fewer compliance hours. Furthermore, we exploit the introduction of the post-employment restriction on the SEC in 2014, which restricted the surface job alternatives of SEC staff who have been above the wage threshold. The newly imposed restriction led to elevated enforcement actions by SEC attorneys who have been above the edge and thus had fewer outdoors choices. General, the proof is according to regulatory seize theories, which counsel that revolving door incentives can result in regulatory leniency.

Within the final a part of the paper, we analyze potential coverage responses to the revolving door incentives utilizing a structural mannequin calibrated to our estimates. We present that imposing post-employment restrictions alleviates the inducement distortion whereas lowering labor provide to the general public sector. A counterfactual coverage that will increase the post-employment restriction to 2 years would scale back the leniency by 0.5% whereas lowering the labor provide by 0.13%. This happens because the attractiveness of the personal sector choice diminishes with an extended restriction interval, making authorities roles much less attractive. Conversely, eliminating these restrictions may increase recruitment by 0.2%, however it could escalate regulatory leniency by 1.7%. Nevertheless, the broader financial implications of those insurance policies stay restricted, on condition that staff can strategically place themselves just under the edge.

Various methods might show extra impactful. For instance, we take into account a situation with stronger governance mechanisms, such that regulators who present leniency are twice as prone to be caught and reprimanded. On this situation, leniency declines by 50% however labor provide to the general public sector declines by 4.1%. Intuitively, a authorities place will help get hold of an much more profitable place within the personal sector. With stronger governance this benefit is lowered, resulting in fewer new entrants to the general public sector.

Analyzing Revolving Door Incentives When Brokers Are Nonetheless Regulators

Our work offers the primary systematic proof of revolving door incentives within the federal authorities. Concretely, we provide 4 contributions. First, present research usually observe the revolving door solely after the worker leaves the federal government. In distinction, we establish the causal response to the surface choice amongst those that are nonetheless employed within the federal authorities. Second, present papers give attention to the revolving door between particular businesses and particular industries, resembling financial institution supervisors and patent examiners, and the way that impacts agency-specific regulatory actions. This narrower evaluation leaves open the query of how widespread and consequential the revolving door phenomenon is. In distinction, we examine all the federal workforce and join revolving door incentives to basic metrics of regulatory burden. Third, we assess the efficacy of insurance policies associated to the revolving door utilizing a structural mannequin and supply two novel insights. The primary is that threshold-based insurance policies are vulnerable to manipulation if brokers can alter their place relative to the edge. In truth, a extra stringent coverage will result in much more manipulation. Second, any coverage would require a trade-off between labor provide to the general public sector and regulatory leniency. Our outcomes quantify this trade-off and might thus inform the talk on easy methods to enhance the efficiency of regulatory businesses additional. Our fourth contribution is to the talk between regulatory seize and regulatory education hypotheses. Our findings are principally according to theories of regulatory seize and show that the surface choice results in a lowered regulatory burden on corporations.

Extra broadly, our work pertains to the literature on incentives and efficiency of regulatory businesses. Prior research have explored the position of salaries and promotions, and organizational options such because the geographic distribution of discipline places of work and jurisdictional overlap. We give attention to a strong incentive, the choice to work in a regulated agency, and illustrate how this incentive might draw people into public service whereas additionally probably distorting their regulatory choices.

Articles symbolize the opinions of their writers, not essentially these of the College of Chicago, the Sales space Faculty of Enterprise, or its school.

Originally posted 2023-10-30 10:00:00.