Financial institution regulators have at all times assumed that financial institution deposits are ‘sticky,’ however the introduction of digital banking is altering that. New analysis focuses not on the hazard of financial institution runs, however moderately on the brand new risks of ‘financial institution walks.’

From April 2022, when the Fed began rising rates of interest, $860 billion of financial institution deposits disappeared, almost definitely moved by people into higher-yielding cash market funds. Two-thirds of that transfer occurred earlier than the collapse of SVB. It’s a silent stroll that can’t be stopped by any deposit insurance coverage and that can undermine the soundness of the banking system within the months to return.

After the collapse of Silicon Valley Financial institution (SVB), many commentators have pointed fingers at social media, accountable for accelerating the financial institution run that killed SVB. Much less consideration has been devoted to the function cellular banking has performed not solely in SVB’s financial institution run but additionally within the previous large exodus of deposits from the banking sector. Whereas this exodus of funds from banks passed off extra slowly — extra akin to a financial institution stroll than a financial institution run— it’s equally, if no more, momentous for the banking system.

To know the issue we have to begin from the regulators’ view of banks. As fantastically illustrated by the interview of Eric Rosengren within the podcast Capitalisn’t, regulators assume that deposits are sticky, that means that they don’t seem to be being moved round fairly often by their house owners. If they’re certainly sticky, banks can afford to undergo some losses of their held-to-maturity belongings, particularly if these losses are on account of rate of interest threat and to not credit score threat as a result of at maturity, a Treasury bond will return the promised quantity.

Thus, if deposits stick round, the financial institution can cowl them. That is the justification for why held-to-maturity belongings are usually not marked-to-market. Since they don’t seem to be marked to market, they don’t seem to be even hedged, as a result of the hedging of an asset marked-to-book would generate very excessive volatility of earnings, which financial institution executives hate.

All the financial institution regulatory construction relies on the belief that deposits are sticky. Traditionally, this assumption was true. However is it nonetheless true? If not, what does it imply for the soundness of our banking system and the flexibleness of our financial coverage?

Sadly, there’s treasured little analysis on the subject, so we determined to take a look at the info. The appearance of digital banking represents one of the crucial necessary structural adjustments in US banking in current reminiscence. We proxy for digital banking typically through the use of information on banks’ cellular purposes.

For the reason that Nice Monetary Disaster in 2008, over half of the roughly 4,000 current banks have launched a cellular app. In lots of instances, the app is clunky and only a few clients use it. In others, it’s the essential approach clients work together with the financial institution. Happily, Koont is ready to measure using cellular apps by trying on the variety of opinions an app receives on both the Apple or Android app retailer, in her research of the results of digitalization on the soundness of the banking sector.

Digital banking presents clients the potential of switching deposits with out leaving their sofas. It additionally makes the invention of the charges provided by various funding automobiles simpler. Thus, it’s affordable to count on that deposits in banks with a well-functioning cellular app might be much less sticky than deposits in banks with out such a handy app. Is that true? Sadly, the info on deposit disaggregated by banks is obtainable solely till the tip of 2022. But, there is a bonus in ignoring the current months: no matter motion occurred in 2022 couldn’t be attributed to a financial institution run. Thus, we actually focus simply on the digital deposits stroll.

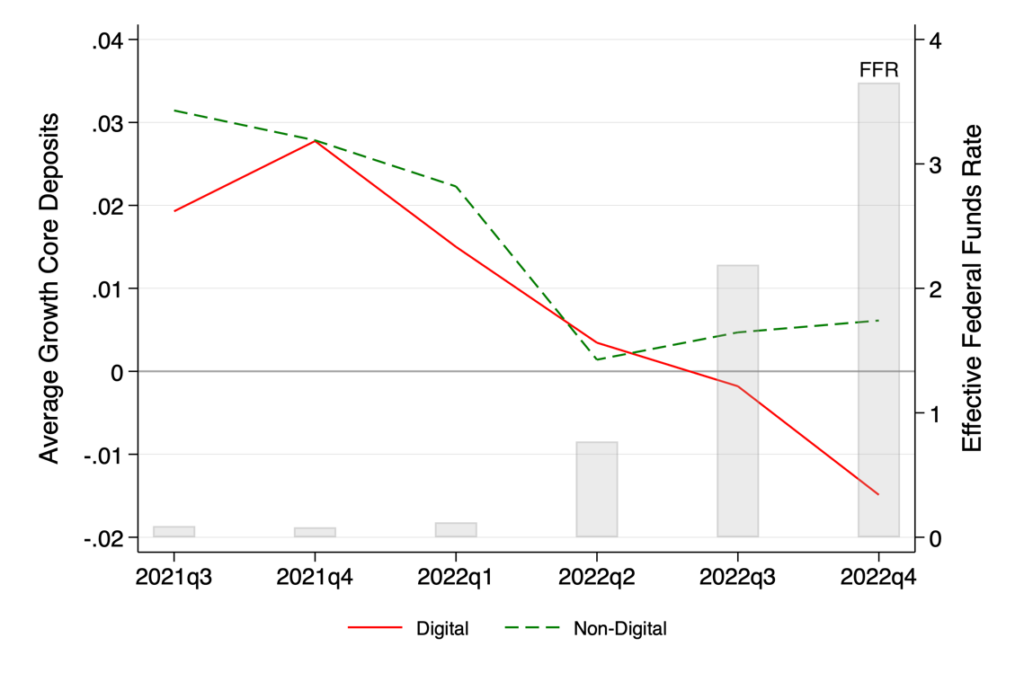

Determine 1 reveals the quarterly common development in core deposits, computed individually for digital and non-digital banks. We prohibit the pattern to banks between $5 and $250B in belongings, as they’ve been so the main focus of the current information. Digital banks are people who have a minimum of 300 cellular app opinions and which have log(variety of opinions)/log(deposits) above the 75th percentile.

The speed of development of deposits of digital banks diverges sharply within the second quarter of 2022 from that of non-digital banks, which aligns with the timing of an uptick within the tempo of fed funds fee will increase. The truth is, digital banks begin experiencing deposit outflows within the third quarter of 2022.

FIGURE 1

A lot has been made from the differential habits of insured versus uninsured deposits. After we prohibit our consideration to insured deposits, under the assured degree of $250,000, the image appears to be like equivalent. No matter is occurring with the banking system is not only concerning the flight of uninsured deposits.

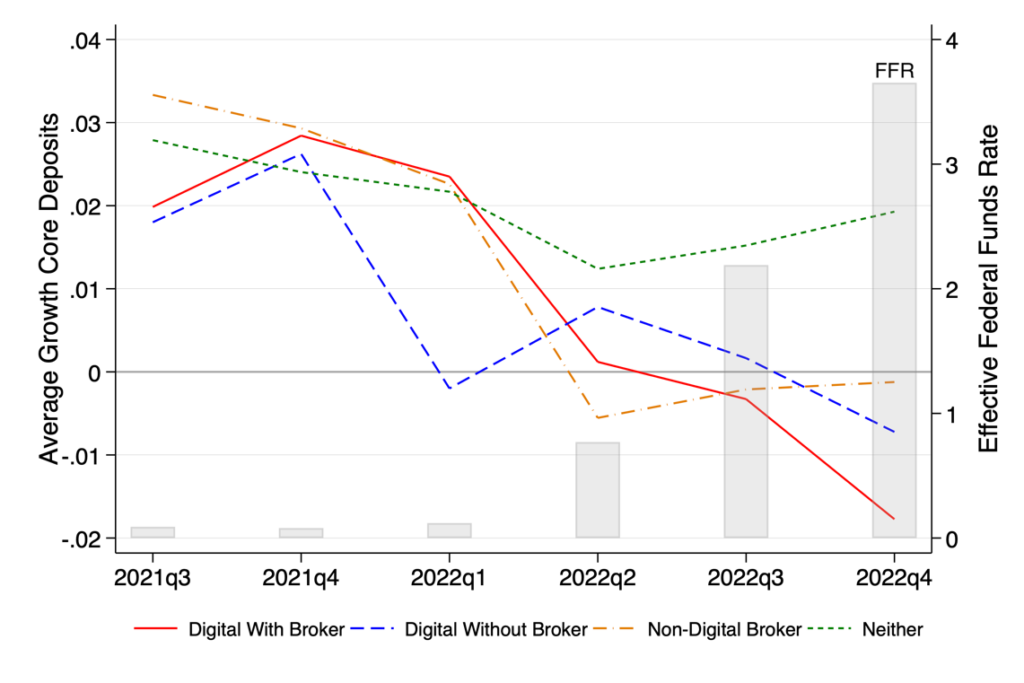

The place are the deposits flowing to? The almost definitely outlet is cash market funds or Treasury payments and bonds straight, the place customers can now get higher yields on their money. If so, banks that personal a brokerage may very well facilitate clients’ means to maneuver out their deposits. As Google likes to repeat, competitors for deposits is “a click on away.” To discover this, we categorize banks into people who have a brokerage, measured as non-zero revenue in charges and commissions from securities brokerage of their regulatory Name Studies. We discover that 10% of banks report nonzero brokerage revenue. In Determine 2 we reproduce Determine 1 however now we break up the pattern into 4 teams: Digital and non-digital and banks with brokerage charges versus people who don’t report these charges.

FIGURE 2

The distinction may be very stark. Banks with neither an efficient cellular app, nor a brokerage account see their deposits develop at a gradual 1.5% fee within the third and fourth quarter of 2022, despite the rising rates of interest. Against this, banks which have each a functioning cellular app and a brokerage account see their deposits drop by 2% within the fourth quarter of 2022.

In a forthcoming working paper, we use a panel of financial institution deposit development from 2010 to 2022 to measure the elasticity of deposit development to adjustments within the federal fund fee. We discover {that a} 400bps improve within the fed funds fee, roughly what the Fed elevated charges in 2022, results in a 9.6% drop differential relative to pattern in core deposit development for non-digital banks that don’t report any brokerage charges. The differential drop turns into 15.2% for digital banks reporting brokerage charges.

The truth that a financial institution has a digital app and/or a brokerage account could correlate with different traits that make deposits behave in another way. To dispel this chance in our forthcoming paper we think about deposit flows within-bank-year (that’s, we embrace a bank-year mounted impact), variation throughout their department networks. We estimate a bank-county-year panel regression for the universe of banks over the interval 2010 via 2022. Particularly, for a given financial institution, we have a look at whether or not deposit flows are extra delicate in counties which have increased web utilization, relying on whether or not the financial institution is digital or not. Family web utilization comes from the Census ACS 2019 5Y, outlined because the proportion of households in a county which have web subscriptions. We additionally embrace state-year mounted impact in order that identification comes solely from counties inside a given state and, lastly, county mounted results to soak up out time-invariant variations throughout counties.

We discover that banks’ deposit outflows are extra pronounced in markets with increased web utilization, however that that is solely the case for digital banks, no matter whether or not they report brokerage charges or not. County-level deposit outflows are 6% bigger, and fee will increase are 20% bigger for a given digital financial institution that studies brokerage charges in counties with 100% family web utilization when in comparison with counties with no web utilization in any way.

It’s clear that deposits have grow to be a lot much less sticky, particularly in banks with well-functioning cellular apps and a brokerage, like Silicon Valley Financial institution and First Republic Financial institution. This isn’t an issue if these banks should not have giant losses of their held-to-maturity belongings or of their mortgage portfolio. In the event that they do, nonetheless, this mobility will slowly expose losses that the banks can not face.

The financial institution runs now we have witnessed are solely the inevitable final act of a tragedy that begins with a silent digital deposit financial institution stroll. Insuring these deposits won’t be enough, since even the insured deposits are leaving. Reducing the short-term rate of interest won’t assist both. If this lower is perceived as short-term, it might need no impact (or perhaps a reverse impact) on the long-term Treasury fee, presumably exacerbating the losses.

Paradoxically, the one coverage that may save these banks is a critical downturn within the financial system, which can lower long-term charges and scale back financial institution losses. In different phrases, the Fed could have to crash the financial system to be able to repair its previous regulatory errors. The time has come to replace the regulatory view that takes the soundness of deposits as given. The price of ignoring this variation is just too excessive to bear.

Articles signify the opinions of their writers, not essentially these of the College of Chicago, the Sales space College of Enterprise, or its college.

Originally posted 2023-04-04 10:00:00.