The effectiveness of tax coverage will depend on whether or not sellers move on adjustments in tax charges to customers by way of adjustments in value. In new analysis, Felix Montag, Robin Mamrak, Alina Sagimuldina, and Monika Schnitzer examine how this tax pass-through in flip will depend on how a lot customers find out about costs. They present that if customers will not be conscious of how costs for a similar product fluctuate between sellers, then they are going to be unaffected by tax adjustments meant to extend or lower consumption.

Policymakers continuously implement tax insurance policies with the intention of adjusting customers’ conduct. For instance, many international locations have launched carbon pricing to deal with local weather change by charging companies for carbon emissions, or they levy sin taxes on merchandise like tobacco, alcohol, and sugar to discourage consumption and enhance public well being. Equally, some governments quickly decreased gross sales and value-added taxes in response to the Covid-19 pandemic to stimulate the financial system. In all these circumstances, tax coverage will solely have an effect on client conduct if companies move the tax (change) on to customers by way of a change in value slightly than soak up it into their revenue margins.

In a current working paper, we examine how imperfect client details about costs impacts the pass-through of commodity taxes. Whereas most prior research on tax pass-through assume that customers know the costs of all sellers in a market for a similar product (good client data), this assumption is commonly unrealistic in follow. In our examine, we concentrate on the retail gasoline market in Germany and France. This market includes a excessive diploma of value transparency, as customers can simply entry real-time costs of all stations on value comparability apps. But, many customers don’t use these apps and, therefore, they lack data about costs.

The important thing instinct for why client data issues is straightforward: if customers have no idea the costs of competing sellers, they’re unlikely to change to cheaper sellers. This softens competitors out there and permits sellers to derive market energy from the dearth of client data, which in the end impacts tax pass-through.

Our outcomes have three key coverage implications. First, the extra customers know all costs, the upper is the worth change in response to a tax change. Second, pass-through could be small even when there are a lot of sellers in a market. Subsequently, the variety of sellers will not be essentially a superb predictor for the depth of competitors. Lastly, our outcomes recommend that taxation impacts totally different client teams in a different way: tax financial savings are handed by way of extra to knowledgeable customers, whereas pass-through to uninformed customers is small. This could have distributional implications and restrict the opportunity of stimulating the financial system by way of (momentary) tax reductions. Total, these implications might change the attractiveness of taxes relative to different coverage devices corresponding to regulation.

We start our analysis by establishing a theoretical client search mannequin, the place a fraction of customers is absolutely knowledgeable about costs, however others must seek for costs sequentially at some value. Within the retail gasoline market, knowledgeable customers correspond to app customers, whereas non-users would want to drive from station to station to find out about costs. Theoretically, knowledgeable customers purchase from the lowest-price vendor, whereas uninformed customers purchase from the primary vendor that they encounter. Subsequently, sellers face a trade-off between which client sort they need to goal when setting their costs. By selecting a low value, a vendor serves its share of uninformed customers and attracts knowledgeable customers however earns a low margin. Conversely, when setting a better value, knowledgeable customers purchase from one other station, however the vendor earns a better margin from its share of uninformed customers.

One vital implication from this mannequin is that it predicts random value dispersion inside a market, that means that sellers are detached between focusing on knowledgeable or uninformed customers and consequentially select their costs with a point of arbitrariness. We present that there’s substantial value dispersion inside native gasoline markets in Germany that’s utterly unpredictable to customers. This means that imperfect client data performs a related function within the German retail gasoline sector.

One other key function of the German gasoline market is the existence of various gasoline varieties. The broadest distinction is between diesel and gasoline, which customers can’t substitute. As well as, there are two several types of gasoline, E5 and E10, that can be utilized by virtually all gasoline automobiles in Germany. They don’t differ in high quality, however E10 has an ethanol share of 10% in comparison with 5% for E5.

We discover proof suggesting that customers of various gasoline varieties differ within the diploma to which they’re knowledgeable about costs. As diesel automobiles statistically have round double the mileage of gasoline automobiles, diesel drivers have a better incentive to develop into knowledgeable about costs to economize. Equally, amongst gasoline drivers, these fueling E10 are sometimes higher knowledgeable about costs, as E10 is normally 4-6 cents per liter cheaper than E5. But, many gasoline drivers use E5 regardless of its larger value, indicating that these customers will not be very value delicate. Utilizing search knowledge from one German value comparability app, we verify that app utilization is most typical amongst diesel drivers and least prevalent amongst drivers shopping for E5.

With this mannequin in hand, we will take a look at its predictions utilizing wealthy knowledge on all gasoline costs in any respect stations in Germany and France. We concentrate on a short lived discount within the German value-added tax (VAT) from 19% to 16% that was carried out in July 2020 in response to the Covid-19 pandemic. To estimate the pass-through of this tax lower in addition to the next tax improve in January 2021, we examine the evolution of gasoline costs at German and French stations. We use France as a management group, since it’s just like Germany in market traits however didn’t expertise any tax change within the related interval.

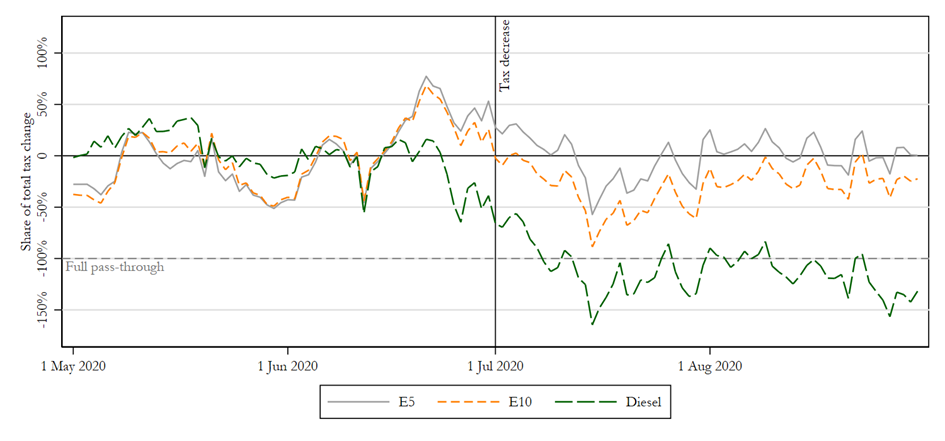

Our examine yields three important findings. First, a tax lower interprets into decrease costs when the share of well-informed customers is bigger. Equally, a brand new tax interprets into larger costs when there are extra well-informed customers. In concept, it is because a better diploma of client data intensifies competitors between sellers. Empirically, we discover that pass-through of each the tax lower and the next tax improve was highest for diesel, adopted by E10 and E5. That is in line with the truth that extra diesel drivers use value comparability apps and are nicely knowledgeable about costs, and that there are extra well-informed drivers buying E10 than E5. The result’s illustrated in Determine 1 for the tax lower on July 1, 2020, which depicts the common each day distinction in gasoline costs between Germany and France, normalized by the common distinction within the two months previous to the tax change and divided by the scale of the tax change. The determine reveals that German diesel costs decreased by across the similar magnitude because the tax change, whereas there was near zero pass-through for E5.

Determine 1: Value adjustments in Germany vs. France

Second, we discover that the pass-through is larger for well-informed customers than uninformed customers. We empirically estimate the distinction in pass-through charges between the minimal and common value in an area market and discover that this distinction is optimistic generally.

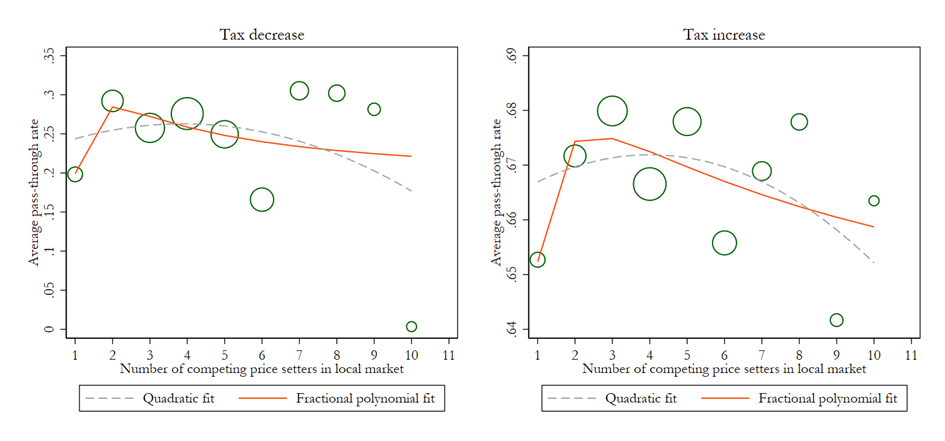

Our third key result’s that extra sellers can typically result in larger and typically to decrease pass-through charges. This contrasts with the usual fashions of full data, which typically predict that pass-through will increase because the variety of rivals will increase. Nonetheless, when accounting for imperfect data, there’s a countervailing impact that raises the worth because the variety of sellers will increase. With many rivals, there may be much less of an opportunity that anybody vendor affords the bottom value and attracts all knowledgeable customers. This incentivizes sellers to cost a better value as a substitute, which reduces pass-through. The ensuing relationship between the variety of sellers and the pass-through price is illustrated in Determine 2 for the case of E5. The scale of the circles corresponds to the relative frequency of every market dimension in Germany. The fitted traces level to an inverse-U or hump-shaped relationship each for the tax lower on the left and the tax improve on the suitable. This sample is in line with simulations of our theoretical mannequin and appears comparable for the opposite gasoline varieties.

Determine 2: Go-through by variety of rivals (E5)

Our outcomes are broadly relevant past simply gasoline costs. As an illustration, different research used fashions of competitors with imperfect data to clarify value variations between on-line and offline retail shops. Our work builds on this strategy to make clear how imperfect client data impacts tax pass-through.

Articles symbolize the opinions of their writers, not essentially these of the College of Chicago, the Sales space College of Enterprise, or its college.

Originally posted 2023-11-16 11:00:00.